Conversion Results

Amount to Convert: $

Tax Rate: %

Estimated Taxes: $

Total After Conversion: $

What is an IRA to Roth IRA Conversion?

An IRA to Roth IRA conversion is when you move money from one retirement account called a Traditional IRA to another account called a Roth IRA. Both of these accounts help you save money for the future, but they work in different ways.

- In a Traditional IRA, you don’t pay taxes on the money you put in. But when you take the money out later (usually after you retire), you have to pay taxes.

- In a Roth IRA, you pay taxes on the money before you put it in, but when you take it out in the future, it’s tax-free! This means no taxes when you withdraw money in retirement.

A conversion is a way of changing your money from a Traditional IRA to a Roth IRA so that it can grow without taxes when you retire.

Why Should You Consider a Roth IRA Conversion?

People decide to convert their Traditional IRA to a Roth IRA for a few important reasons:

- Tax-Free Growth: Once your money is in a Roth IRA, it can grow without being taxed. This means you won’t have to pay any taxes when you take the money out in the future. This is a big advantage if you expect your money to grow a lot over time.

- No Required Minimum Distributions (RMDs): With a Traditional IRA, the government requires you to start taking money out when you turn 73, and you have to pay taxes on that money. But with a Roth IRA, there are no RMDs. You can keep your money growing for as long as you want without being forced to take it out.

- Future Tax Savings: If you think your taxes will be higher when you retire, converting to a Roth IRA might be a smart move. You pay taxes now (while they are lower) instead of later when they might be higher.

A Roth IRA conversion calculator can help you figure out how much tax you might need to pay when making the conversion, so you can plan better and avoid surprises.

How Does a Roth IRA Conversion Work?

Step-by-Step Process of Converting an IRA to a Roth IRA

Converting a Traditional IRA to a Roth IRA isn’t too difficult, but it does require some steps. Here’s how it works:

- Step 1: Decide to Convert

- First, you decide that you want to move your money from your Traditional IRA to a Roth IRA. This can happen at any time, but you’ll need to think about when it’s best for your finances.

- Step 2: Contact Your IRA Provider

- You will need to talk to the company where you have your Traditional IRA. They will help you start the conversion process, which usually involves filling out some paperwork or submitting an online form.

- Step 3: Pay the Taxes

- When you convert, you’ll need to pay taxes on the money you’re moving from your Traditional IRA to your Roth IRA. This is because, with a Traditional IRA, you didn’t pay taxes when you put the money in, so now you have to pay taxes on it.

- The amount you pay in taxes depends on how much you convert and what tax bracket you fall into.

- Step 4: Money Goes Into Your Roth IRA

- Once the taxes are paid, the money moves into your Roth IRA. From there on, the money can grow without paying taxes when you take it out in the future.

- Step 5: Keep Track of Your Roth IRA

- After the conversion, your money is in a Roth IRA, which means you don’t have to pay taxes on it when you withdraw it in retirement. You can keep track of your Roth IRA and let it grow!

What Happens During a Conversion?

When you convert a Traditional IRA to a Roth IRA, your money changes how it will be taxed. Let’s look at the differences:

- Before the Conversion: In a Traditional IRA, the money you put in isn’t taxed yet. You only pay taxes when you take it out in retirement.

- After the Conversion: In a Roth IRA, the money you put in is already taxed, but when you take it out later, you don’t have to pay any taxes! So, your money grows without the government taking a share when you retire.

Key Differences Between Traditional IRA and Roth IRA

- Traditional IRA: You pay taxes on the money when you take it out in retirement.

- Roth IRA: You pay taxes on the money when you put it in, but it grows tax-free, and you don’t pay taxes when you take it out in the future.

Roth IRA Conversion Calculator Explained

How to Use an IRA to Roth Conversion Calculator

A Roth IRA conversion calculator is a tool that helps you figure out how much money you’ll need to pay in taxes when converting your Traditional IRA to a Roth IRA. It’s very useful because it takes the guesswork out of the conversion process.

Here’s how to use it:

- Enter the Amount You Want to Convert: You will need to know how much money you plan to move from your Traditional IRA to your Roth IRA. This is the first thing the calculator will ask you.

- Enter Your Current Tax Rate: The calculator will ask for your current tax rate, which is how much tax you pay on your income. This helps the calculator figure out how much tax you will owe on the amount you’re converting.

- Enter Your Expected Income in the Future: Some calculators ask about your expected income after the conversion. This helps predict if your tax rate will change in the future, affecting how much you’ll owe in taxes.

- Calculate: Once you’ve entered all the information, click the “Calculate” button. The calculator will show you how much tax you’ll need to pay now for the conversion and how much money will go into your Roth IRA.

Benefits of Using a Calculator for Your Conversion

Using a Roth IRA conversion calculator helps in many ways:

- Know How Much Tax You’ll Pay: The calculator helps you estimate exactly how much tax you’ll owe now. This way, you won’t be surprised by a huge tax bill later.

- Plan for Your Retirement: It also helps you see how much money you will have in your Roth IRA after the conversion. This is helpful for planning your future and making sure you have enough money to retire comfortably.

- Make Smarter Decisions: A calculator can also help you decide how much to convert. If you convert too much, you might move into a higher tax bracket and end up paying more taxes. The calculator can guide you on how much is best to convert each year.

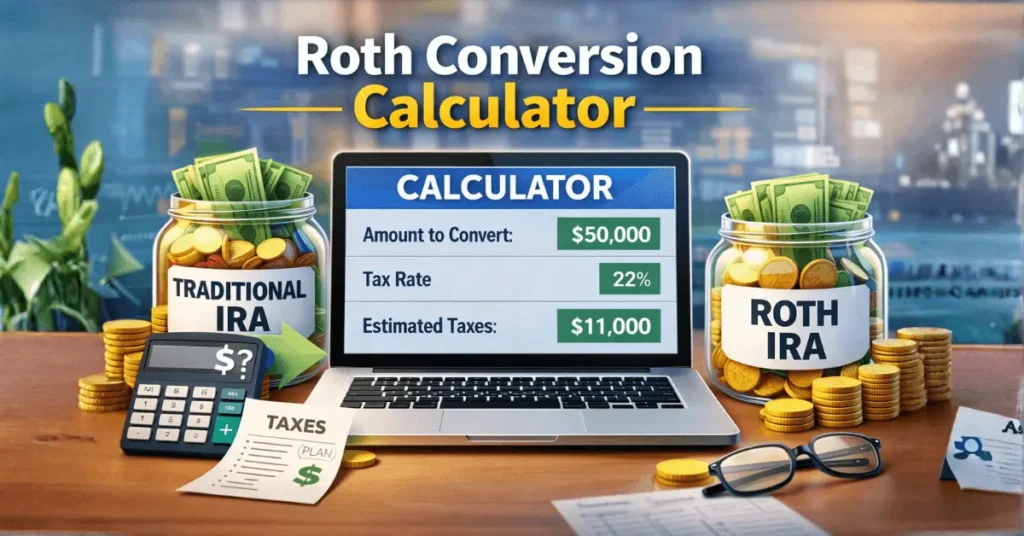

Sample Calculation (Real-life Example)

Let’s see how this works with a simple example:

- Imagine you have $50,000 in your Traditional IRA and you want to convert it to a Roth IRA.

- You are in the 22% tax bracket (meaning you pay 22% tax on your income).

- After entering this information into the Roth IRA conversion calculator, it might show that you’ll need to pay $11,000 in taxes (22% of $50,000).

So, after the taxes are paid, you’ll have $39,000 left that will go into your Roth IRA. This $39,000 will now grow without being taxed when you take it out in retirement.

Tax Implications of Converting an IRA to a Roth IRA

How Conversions Impact Your Tax Bracket

When you convert a Traditional IRA to a Roth IRA, the money you move is treated as income for the year. This means that it could push you into a higher tax bracket, depending on how much you’re converting and what other income you have.

- Example: If you normally make $40,000 a year and you decide to convert $20,000 from your Traditional IRA to a Roth IRA, you’ll now be taxed on $60,000 of income (your regular income plus the converted amount). If this pushes you into a higher tax bracket, you’ll pay more taxes.

A tax bracket is simply a range of income that is taxed at a certain rate. The higher your income, the higher the percentage you pay in taxes.

Why Does This Matter?

- Converting a large amount of money in one year can make you pay a higher percentage in taxes than if you convert smaller amounts over time.

- If you can, it’s often better to spread out your conversion over multiple years to avoid a big tax bill in one year.

How Much Tax Will You Pay? (Using the Calculator)

The amount of tax you’ll pay when you convert your IRA to a Roth IRA depends on several factors:

- Your Income: The more money you make, the higher your tax rate may be.

- The Amount You Convert: The more you convert, the higher your taxable income becomes, which might push you into a higher tax bracket.

Example: Let’s say you convert $50,000 from your Traditional IRA to a Roth IRA. If you are in the 22% tax bracket, you’ll pay 22% of $50,000, which is $11,000 in taxes. This tax will need to be paid from other savings or income, not from the IRA funds.

Tip: Always make sure you have enough funds to pay the taxes without taking the money from the IRA itself, or you’ll lose the benefit of that money growing in your Roth IRA.

What Happens if You Convert Too Much?

It’s important not to convert too much in one year. If you convert too much money, you could end up in a higher tax bracket, meaning you’ll pay a larger percentage of your income in taxes.

- Example: Let’s say you are in the 22% tax bracket with a total income of $40,000. If you convert $50,000 from your IRA, your taxable income for the year will be $90,000. This could push you into the 24% tax bracket (instead of staying at 22%).

This is why using a calculator is so important—it helps you see how much tax you’ll owe and whether converting all your money in one year is a smart choice.

Penalties to Watch Out For

While there are no penalties for converting your IRA to a Roth IRA, there are some important things to keep in mind:

- Taxes: The most important “penalty” is the taxes you have to pay. If you convert a large amount, it could create a large tax bill.

- Early Withdrawal Penalties: If you take money out of your Roth IRA too soon (before 5 years or before age 59½), you could face a penalty. But this is not related to the conversion itself; it’s just a rule for Roth IRAs in general.

Eligibility for IRA to Roth IRA Conversion

Income Limits for Conversions

One of the best things about converting a Traditional IRA to a Roth IRA is that there are no income limits on who can do it! This means anyone, no matter how much money they make, can convert a Traditional IRA to a Roth IRA.

However, the government has income limits for how much you can contribute directly to a Roth IRA each year. For example, if you make too much money, you can’t add new money directly to a Roth IRA. But when it comes to conversions, you can still do it no matter how high your income is.

So, if you’ve reached the income limit for contributing to a Roth IRA, converting a Traditional IRA to a Roth IRA can be a great option for you.

Who Can Benefit the Most from a Roth Conversion?

While anyone can convert, some people benefit more than others. Here are a few situations where a Roth IRA conversion makes a lot of sense:

- People with Lower Incomes (or Lower Tax Brackets):

- If you’re in a lower tax bracket right now (for example, you make less money or are in the early years of your career), it might be a good time to convert. You’ll pay less tax on the amount you convert because you’re taxed at a lower rate.

- People Who Expect Higher Taxes in the Future:

- If you think that taxes will be higher when you retire, it could be smart to convert now. By paying taxes today at a lower rate, you won’t have to worry about paying taxes when you take money out in retirement.

- People Who Don’t Need the Money Right Away:

- Since Roth IRAs don’t have required minimum distributions (RMDs), it’s a great option for people who want their money to grow for a long time and don’t need to take it out right away.

- People Who Want Tax-Free Growth:

- If you’re looking to make your savings grow tax-free, a Roth IRA is a great option. Since you don’t pay taxes on withdrawals from a Roth IRA, you can let your money grow and compound without worrying about taxes cutting into your growth.

Special Considerations for High-Income Earners

If you’re a high-income earner, converting to a Roth IRA could be a way to enjoy the benefits of tax-free growth. But there are a few things to keep in mind:

- Paying Taxes: High-income earners may face a larger tax bill when converting a big amount of money. That’s why it’s especially important to plan carefully. A Roth IRA conversion calculator can help you figure out the best amount to convert each year to minimize taxes.

- Timing the Conversion: If you have a year with lower income (for example, if you retire early or take a sabbatical), it might be a good time to convert some of your Traditional IRA money to a Roth IRA, because you’ll likely be in a lower tax bracket for that year.

- Avoiding Large One-Time Taxes: A strategy that high-income earners use is converting a smaller amount each year. This way, they don’t increase their taxable income too much all at once and can stay in a lower tax bracket each year.

Roth IRA Conversion Strategies

When is the Best Time to Convert Your IRA?

The best time to convert your Traditional IRA to a Roth IRA depends on a few important factors, like your current income, your future income, and how much tax you want to pay.

Here are some key times when it might make sense to convert:

- When You’re in a Lower Tax Bracket:

- If your income is lower than usual in a particular year (for example, if you’re taking a break from work or if you’ve retired early), you might be in a lower tax bracket. This is a great time to convert your IRA, because you’ll pay less tax on the money you convert.

- In Your Early Career or Retirement:

- If you’re just starting your career or you’re retired, you might have lower income for a few years. During these years, converting can be a smart choice since you’re paying tax at a lower rate.

- Before a Big Raise or Promotion:

- If you know that your income will be significantly higher in the next few years (because of a raise, promotion, or new job), it might be better to convert some of your Traditional IRA money now, when you’re in a lower tax bracket.

Converting in Phases to Minimize Taxes

Converting a large amount of money all at once can push you into a higher tax bracket, meaning you’ll end up paying more taxes. To avoid this, many people choose to convert smaller amounts each year.

- For example, instead of converting $50,000 all at once, you could convert $10,000 each year over five years. This way, you’ll pay taxes on a smaller amount each year and won’t push yourself into a higher tax bracket.

Why This Is Helpful:

- This strategy can help keep your tax bill lower and avoid surprises when tax season comes around. It’s a good way to spread out the tax burden and take advantage of lower tax rates.

Advanced Conversion Strategies for High-Income Individuals

If you’re a high-income earner, the conversion process might seem more complicated because of the large tax bills that can come with it. However, there are some strategies to help make the process smoother:

- Use a Backdoor Roth IRA:

- High-income earners often use a strategy called the “Backdoor Roth IRA”. This involves making a contribution to a Traditional IRA (which doesn’t have income limits) and then converting that money to a Roth IRA. It’s a way around the income limits for direct Roth IRA contributions.

- Convert During a Year with Lower Income:

- If you know that you’ll have a year with low income (maybe due to a sabbatical, business loss, or other factors), you can use that year to do a bigger conversion at a lower tax rate.

- Consider Future Tax Rates:

- If you believe that tax rates will be higher in the future, it might make sense to convert more of your Traditional IRA to a Roth IRA now while tax rates are still lower. This is a strategy that can be particularly useful if you’re planning for long-term growth in your Roth IRA.

- Don’t Convert Too Much in One Year:

- As mentioned earlier, it’s important not to convert too much at once. This can push you into a higher tax bracket and lead to a big tax bill. Instead, aim to convert amounts that keep you in a lower tax bracket and plan your conversions over time.

Roth IRA Benefits

Tax-Free Growth and Withdrawals

One of the biggest benefits of converting to a Roth IRA is that the money you put in grows tax-free. This means that once your money is in the Roth IRA, you don’t have to pay any taxes on the earnings when you take the money out in retirement. It’s like planting a tree and watching it grow without having to share any of the fruit with anyone!

Here’s how it works:

- In a Traditional IRA, you don’t pay taxes on the money you put in, but you do have to pay taxes when you take the money out later.

- In a Roth IRA, you pay taxes on the money when you first put it in, but then it grows without ever being taxed again.

Why this matters: If your money grows a lot over time, you won’t have to pay taxes on those big gains when you retire. This is a great way to save money in the long term.

No Required Minimum Distributions (RMDs)

With a Traditional IRA, the government requires you to start taking money out when you turn 73. This is called a Required Minimum Distribution (RMD), and it means you have to withdraw a certain amount of money each year and pay taxes on it.

However, with a Roth IRA, there are no RMDs! This means you can leave your money in the Roth IRA and let it continue to grow without having to take any of it out until you want to.

Why this matters: This flexibility is huge because you don’t have to worry about the government forcing you to take out money you don’t need. It gives you more control over your savings.

Roth IRA in Retirement Planning

Roth IRAs are not just a good option for saving taxes today; they’re also a great tool for your future retirement. They allow you to build a tax-free income for your retirement years, giving you more options and freedom when it comes to how and when you withdraw your money.

Here are a few reasons why Roth IRAs are a great addition to your retirement plan:

- Tax-Free Withdrawals: You won’t owe any taxes on the money you take out in retirement, which can help you keep more of your savings.

- Flexibility: You can take out your contributions (the money you put in) at any time without paying taxes or penalties. However, to take out the earnings (the growth from your investments), you need to be at least 59½ and have the account for 5 years.

- Estate Planning: Roth IRAs are also great for passing money to your heirs because they won’t have to pay taxes on the money they inherit.

Common Questions and Misconceptions About Roth IRA Conversions

Can I Convert My IRA to a Roth IRA Without Penalties?

Yes, you can convert your Traditional IRA to a Roth IRA without any penalties, as long as you follow the rules. The key thing to remember is that you will pay taxes on the money you convert, but there are no penalties for the conversion itself.

- No Early Withdrawal Penalty: If you’re under the age of 59½, you won’t face an early withdrawal penalty when you convert. The only thing you’ll need to worry about is the taxes.

- Penalty-Free Conversion: As long as you follow the rules and only convert your Traditional IRA to a Roth IRA, there are no penalties for the conversion itself.

Important: However, if you take money out of your Roth IRA too soon (before 5 years or before you turn 59½), you could face penalties on the earnings (the growth) from your Roth IRA.

What Happens If I Convert Too Much or Too Little?

Converting too much or too little can both have consequences, so it’s important to find the right amount to convert. Here’s what can happen:

- If You Convert Too Much:

- If you convert a large amount, it can push you into a higher tax bracket, which means you’ll pay a higher percentage of tax on the conversion amount. This could lead to a bigger tax bill than you expected.

- Example: If you normally make $50,000 a year, but you convert $100,000, your total taxable income for that year would be $150,000. This could push you into a higher tax bracket, and you’ll end up paying more tax.

- If You Convert Too Little:

- On the other hand, if you convert too little, you might not be taking full advantage of your Roth IRA. Converting in smaller amounts over time can be a smart strategy to minimize taxes, but if you don’t convert enough, you might not see the full benefit of the Roth IRA’s tax-free growth in the long run.

- Finding the Right Balance: You’ll want to aim for converting an amount that keeps you in a comfortable tax bracket while still allowing your savings to grow in a tax-free Roth IRA.

Roth Conversion Mistakes to Avoid

Converting your IRA to a Roth IRA is a great strategy, but there are some common mistakes you should avoid:

- Converting Too Much in One Year: As mentioned earlier, converting a large amount all at once can push you into a higher tax bracket and make you pay more taxes than you need to. It's often better to spread out the conversions over several years.

- Not Paying Enough in Taxes: You’ll need to make sure you have enough money outside of your IRA to cover the taxes on the conversion. If you take the tax money from your IRA itself, it will reduce the amount that can grow in the Roth IRA.

- Forgetting About the 5-Year Rule: In a Roth IRA, you can take out your contributions (the money you put in) anytime without taxes or penalties. However, to take out earnings (the growth from your investments), you need to be at least 59½ and have the account for 5 years. If you don’t follow this rule, you could pay penalties on the earnings.

- Converting During a High-Income Year: If you convert a lot of money when your income is high (like after a big raise), it might not be the best time to convert, as it could push you into a higher tax bracket. Try to convert in years when your income is lower to pay fewer taxes.

Conclusion

Converting a Traditional IRA to a Roth IRA is a strategy that allows you to turn your savings into tax-free growth for retirement. While the conversion process is fairly straightforward, there are several key factors to consider, such as:

- Understanding the Tax Implications: When you convert, you will need to pay taxes on the amount you move from the Traditional IRA to the Roth IRA. This is because the money in your Traditional IRA hasn't been taxed yet, and the government requires you to pay taxes during the conversion.

- Choosing the Right Time to Convert: Timing is important. If you're in a lower tax bracket, it's a great time to convert, as you’ll pay less in taxes. For high-income earners, converting in smaller amounts over several years can help minimize your tax burden.

- Using a Roth IRA Conversion Calculator: A Roth IRA conversion calculator is a helpful tool to estimate how much tax you'll need to pay during the conversion. It can help you plan and decide how much to convert each year.

- Knowing the Benefits: Roth IRAs come with tax-free growth, no required minimum distributions (RMDs), and flexibility in how and when you withdraw money in retirement. These advantages make them a great option for long-term retirement planning.

- Avoiding Common Mistakes: Be careful not to convert too much in one year, as it could push you into a higher tax bracket. Also, always make sure you have enough money outside of your IRA to pay the taxes on the conversion.

Next Steps: How to Get Started with Your Roth IRA Conversion

Now that you understand the basics of a Roth IRA conversion, here’s what you can do next:

- Evaluate Your Current IRA: Take a look at how much money you have in your Traditional IRA and consider whether converting some or all of it to a Roth IRA makes sense for you. Think about your current tax bracket and your long-term retirement goals.

- Use a Roth IRA Conversion Calculator: Plug your information into a Roth IRA conversion calculator to see how much tax you would owe on a conversion. This will give you a clearer picture of the financial impact and help you decide how much to convert.

- Consult with a Financial Advisor: If you’re unsure about whether a Roth IRA conversion is right for you or how much you should convert, speaking with a financial advisor can provide personalized advice based on your unique situation.

- Start the Conversion Process: Once you’re ready, contact the company where you hold your Traditional IRA and start the conversion. They will guide you through the process, and you can begin enjoying the benefits of tax-free growth in your Roth IRA.

If you're ready to start planning your Roth IRA conversion or need help calculating how much tax you might owe, use our Roth IRA conversion calculator today! You can also reach out to a financial advisor to discuss how a Roth IRA conversion fits into your long-term retirement strategy.