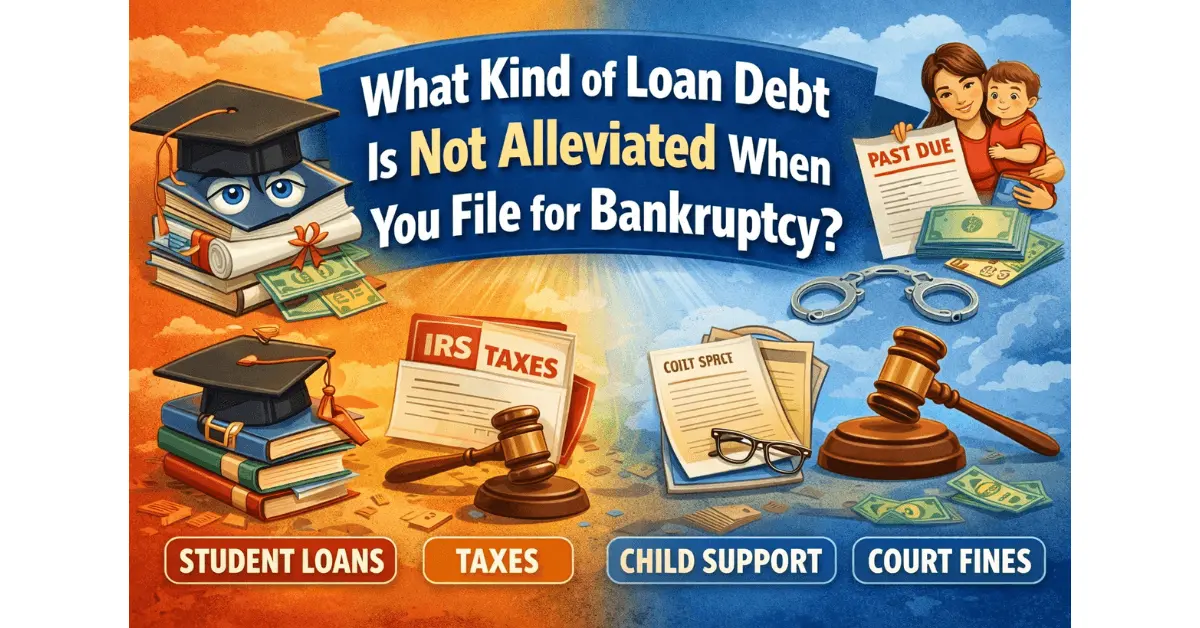

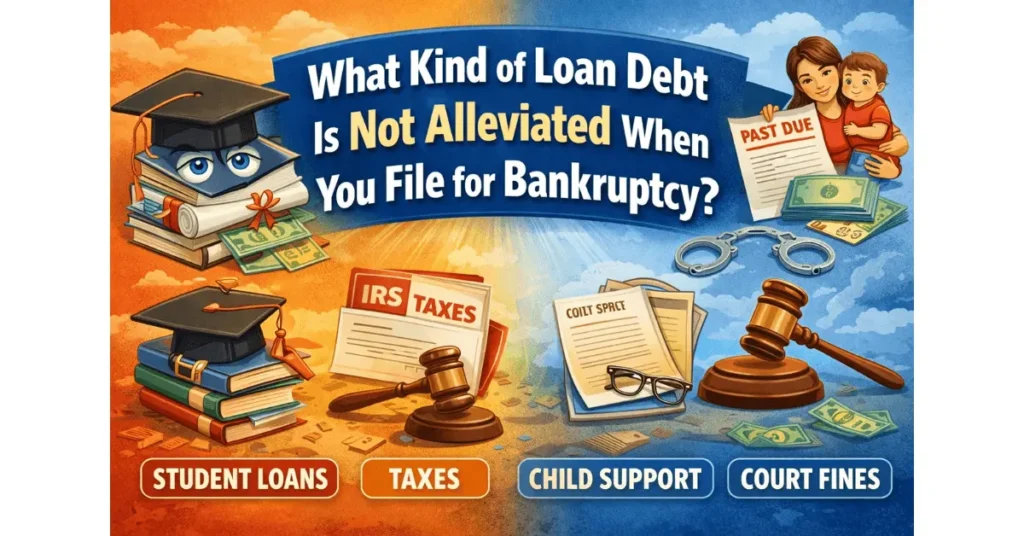

What Happens to Loan Debt in Bankruptcy?

Filing for bankruptcy is a way for people to get help when they can’t pay back the money they owe. When someone files for bankruptcy, it gives them a chance to start over with their finances. But not all debts are treated the same way when you file for bankruptcy. Some loans, like credit card debt or medical bills, can be wiped out, but others can’t.

So, what happens to loan debt when you file for bankruptcy? Some debts will be forgiven or “discharged” by the bankruptcy, meaning you don’t have to pay them anymore. However, there are certain debts that bankruptcy cannot get rid of, no matter what.

We’ll explain which loans and debts are not alleviated (or wiped away) when you file for bankruptcy. Understanding this will help you know what to expect and plan for in the future.

Dischargeable vs. Non-Dischargeable Debts

When you file for bankruptcy, the goal is often to get rid of as many debts as possible. But not all debts are treated the same in bankruptcy. Some debts can be completely erased, while others must still be paid, even after bankruptcy. Let’s look at the difference between dischargeable debts and non-dischargeable debts.

What Are Dischargeable Debts?

Dischargeable debts are the types of debts that bankruptcy can eliminate. When these debts are discharged, you don’t have to pay them anymore. Common dischargeable debts include:

- Credit card debt

- Medical bills

- Personal loans

- Utility bills (like gas, water, electricity)

In simple terms, when you file for bankruptcy, these types of debts go away.

- Example: If you owe $5,000 on your credit card and you file for bankruptcy, that $5,000 could be completely erased, so you no longer owe it.

What Are Non-Dischargeable Debts?

Non-dischargeable debts are the types of debts that bankruptcy cannot remove. No matter what type of bankruptcy you file for, you will still need to pay these debts. Some common non-dischargeable debts are:

- Student loans (in most cases)

- Child support and alimony (money owed to a spouse or for children)

- Court fines and penalties

- Most tax debts (especially recent tax debt)

This means that even if you file for bankruptcy, these debts won’t go away, and you will still have to pay them.

- Example: If you owe $10,000 in student loans and file for bankruptcy, you still have to pay back that $10,000 because student loans are generally not discharged in bankruptcy.

Types of Debt Not Alleviated by Bankruptcy

While bankruptcy can help erase many types of debt, there are certain kinds of debt that will not be forgiven. This means you will still be responsible for paying them, even after you file for bankruptcy. Let’s go over the most common types of debts that bankruptcy cannot get rid of.

1. Student Loan Debt

For most people, student loans are a major part of their debt. Unfortunately, student loan debt is usually not discharged in bankruptcy. This means that even if you file for bankruptcy, you will still have to pay off your student loans.

- Why it’s not alleviated:

- The government and private lenders see student loans as important debts, and they’re very hard to get rid of in bankruptcy. However, in rare cases, if you can prove that paying off the loan would cause you “undue hardship,” it’s possible to get some or all of your student loans discharged.

- Example:

- Let’s say Jane has $30,000 in student loans. If she files for bankruptcy, she will still have to pay those loans, unless she can prove that repaying them would cause her serious financial problems.

2. Tax Debt

Tax debt is another type of debt that bankruptcy can’t easily remove. While certain types of older tax debt may be discharged in bankruptcy, recent tax debts generally remain, especially if you owe money to the IRS (Internal Revenue Service) or your state’s tax agency.

- Why it’s not alleviated:

- Taxes that were due within the past three years are usually non-dischargeable, meaning you still have to pay them. Additionally, if the IRS has filed a tax lien against you, that lien stays even after bankruptcy.

- Example:

- Tom owes $5,000 in back taxes from last year. If he files for bankruptcy, he will still be responsible for paying the $5,000 tax debt because it is recent and non-dischargeable.

3. Child Support and Alimony

Child support and alimony (money owed to a spouse after a divorce) are two types of debts that cannot be discharged in bankruptcy. The courts view these debts as necessary for the well-being of children and spouses, so bankruptcy will not help get rid of them.

- Why it’s not alleviated:

- The goal of child support and alimony is to ensure that children and former spouses receive the financial support they need. Because of this, bankruptcy doesn’t allow these types of debts to be erased.

- Example:

- Maria owes $10,000 in unpaid child support. If she files for bankruptcy, she will still have to pay the child support because it’s a non-dischargeable debt.

4. Court Fines and Penalties

If you owe money because of a court fine or a penalty (such as fines for traffic violations, criminal penalties, or other legal fees), bankruptcy will not discharge these debts either. The court wants to ensure that fines are paid, so they are not included in bankruptcy discharge.

- Why it’s not alleviated:

- Fines are seen as punitive or punishing debts, which means they are meant to enforce legal obligations. As a result, bankruptcy doesn’t remove them.

- Example:

- Alex has a $3,000 fine for a criminal conviction. If he files for bankruptcy, he must still pay this fine, as it cannot be discharged.

5. Secured Debts (Car Loans, Mortgages)

Secured debts, like car loans and mortgages, are a bit different. These loans are tied to an asset — meaning the lender can take the asset (like your car or home) if you don’t make the payments. Bankruptcy may not eliminate these debts, but it might help you keep your car or home in certain situations.

- Why it’s not alleviated:

- With secured debts, the lender has the right to take the property if you don’t pay. However, in Chapter 13 bankruptcy, you might be able to catch up on missed payments and keep the car or house.

- In Chapter 7, you may have to give up the property if you can’t keep up with payments, but you won’t owe the remaining balance if the property is sold.

- Example:

- Mary has a $10,000 car loan and owes $50,000 on her mortgage. Even though she files for bankruptcy, she still needs to pay the car loan and the mortgage or risk losing her car and house, unless she reworks the loans in Chapter 13.

Managing Non-Dischargeable Debts After Bankruptcy

While bankruptcy helps eliminate many types of debt, there are still non-dischargeable debts that you’ll need to deal with even after the bankruptcy process is over. These debts won’t disappear, but there are strategies and options you can consider to manage them. Let’s go over how to handle non-dischargeable debts after bankruptcy and what steps you can take to stay on top of them.

1. Setting Up Payment Plans for Non-Dischargeable Debts

One of the most common ways to manage non-dischargeable debts is by setting up payment plans. This is especially useful for debts like child support, taxes, or student loans. You can work out a manageable repayment plan that fits within your budget.

- How It Works:

- For tax debts, the IRS or your state tax authority may offer options like installment agreements. This allows you to pay off your tax debt over time with smaller, affordable payments.

- If you owe student loans, some lenders may offer income-driven repayment plans, which adjust your monthly payments based on your income.

- Example:

- After filing for bankruptcy, Emily owes $5,000 in back taxes. She sets up an installment agreement with the IRS to pay off the debt in monthly payments of $150. This plan allows her to avoid financial strain and make steady progress toward paying off the debt.

2. Refinancing or Consolidating Loans

If you’re dealing with student loans or car loans, refinancing or consolidating can be helpful for reducing your monthly payments. Refinancing means getting a new loan with better terms (like a lower interest rate), while consolidation involves combining multiple loans into a single loan with one payment.

- How It Works:

- With student loans, refinancing could help you get a lower interest rate, which reduces the amount you pay each month.

- For car loans, refinancing could help lower your monthly payment by extending the loan term or reducing the interest rate.

- Example:

- John has multiple student loans and a car loan. After bankruptcy, he refinances both loans to get a lower interest rate. His car loan payment drops from $400 to $350 per month, and his student loan payment is reduced from $300 to $250 per month, freeing up money for other expenses.

3. Working with a Debt Counselor

If managing non-dischargeable debts feels overwhelming, working with a debt counselor can provide professional help. Debt counselors can assist you in creating a budget, negotiating with creditors, and helping you set up manageable payment plans. Many non-profit agencies offer free or low-cost debt counseling services.

- How It Works:

- A debt counselor will assess your finances and help you come up with a plan to tackle your non-dischargeable debts. They can also negotiate with creditors to potentially reduce interest rates or waive fees.

- Some counselors specialize in helping people with student loan debt or tax debt, offering specific advice for those types of obligations.

- Example:

- After filing for bankruptcy, Mike works with a debt counselor to set up a debt management plan. The counselor helps him create a budget and negotiate with his student loan servicer for a lower monthly payment.

4. Exploring Debt Settlement for Tax Debt

In some cases, tax debt can be negotiated with the IRS or state tax authorities. While bankruptcy won’t eliminate tax debt, you may be able to settle the debt for a lower amount through programs like Offer in Compromise (OIC).

- How It Works:

- The OIC program allows taxpayers to settle their tax debt for less than the full amount if they can prove they’re unable to pay the full debt.

- To qualify for an OIC, you’ll need to submit financial information and show that the full amount of tax debt would cause significant financial hardship.

- Example:

- Lisa owes $15,000 in back taxes but can only afford to pay $5,000. She works with the IRS to apply for an Offer in Compromise, and after reviewing her financial situation, the IRS agrees to accept $5,000 as a full settlement.

5. Staying on Top of Non-Dischargeable Debts

Even though bankruptcy can give you a fresh start, it’s important to stay on top of your non-dischargeable debts to avoid falling back into debt. Make sure to:

- Track your spending to ensure you can make regular payments on non-dischargeable debts.

- Review your credit report regularly to monitor any remaining balances or payments.

- Avoid taking on more debt while paying off these non-dischargeable obligations.

- Example:

- After bankruptcy, George sets up automatic payments for his child support and tax debts. He checks his budget every month to make sure he has enough to cover those payments, which helps him avoid falling behind again.

Conclusion: Next Steps After Filing for Bankruptcy

Filing for bankruptcy can feel like the end of a long and difficult road, but it’s actually a new beginning. Even though non-dischargeable debts won’t be erased through bankruptcy, there are plenty of ways to manage them and get back on track financially. Now that you understand what types of debt won’t be alleviated by bankruptcy and how to manage them, let’s talk about the next steps you can take to rebuild your financial life.

1. Rebuild Your Credit

After bankruptcy, your credit will take a hit, but that doesn’t mean it’s impossible to improve. Rebuilding your credit is one of the first things you should focus on after bankruptcy. Here are some simple ways to get started:

- Use a Secured Credit Card: This is a great tool for rebuilding your credit. You put down a deposit, and that becomes your credit limit. Use the card for small purchases and pay it off every month.

- Make Timely Payments: Pay your bills on time. This includes non-dischargeable debts, like student loans or tax debt. Timely payments are one of the most important factors in improving your credit score.

- Check Your Credit Report: Regularly check your credit report for errors or accounts that may need to be updated.

- Example:

- After filing for bankruptcy, Sarah got a secured credit card with a $200 limit. She used it for small purchases and paid it off every month. Over the next year, her credit score improved from 480 to 650.

2. Stay On Top of Non-Dischargeable Debts

Since non-dischargeable debts (like child support, alimony, and tax debt) cannot be wiped out by bankruptcy, you’ll need to stay organized and keep up with payments. Here’s how to stay on top of these debts:

- Set up automatic payments: This will help ensure that you never miss a payment, making it easier to manage these debts.

- Stay in touch with creditors: If you ever struggle to make a payment, reach out to the creditor (like the IRS or your student loan provider) to see if there’s a way to adjust the payment plan.

- Consider debt settlement: If you can’t afford to pay the full amount, some creditors (especially the IRS) may accept a reduced payment through debt settlement.

- Example:

- John had $10,000 in back taxes after bankruptcy. He set up an automatic payment plan with the IRS to pay off the debt over the next 3 years. His payments are affordable, and he doesn’t have to worry about penalties.

3. Build an Emergency Fund

One of the best ways to avoid falling back into debt after bankruptcy is to start building an emergency fund. This is money you set aside for unexpected expenses, so you don’t have to rely on credit cards or loans when something unexpected happens.

- How to Start:

- Try to save at least $500 to $1,000 in a separate account. This should cover emergencies like car repairs, medical bills, or other unexpected costs.

- Once you’re comfortable with your emergency fund, try to save for longer-term goals like retirement or buying a home.

- Example:

- After bankruptcy, Lily started putting $50 a month into an emergency fund. After a year, she had enough saved to cover a small car repair, which kept her from using credit cards.

4. Avoid Taking on New Debt

After bankruptcy, it’s tempting to start using credit again, but it’s important to avoid taking on too much new debt too soon. Only take on debt when it’s absolutely necessary, and make sure you can manage it.

- How to Manage Debt Going Forward:

- Use a credit card only for purchases you can pay off each month. This will help you avoid getting back into high-interest debt.

- Consider a debt management plan or refinancing if you need to take on new debt, such as for a car loan or mortgage.

- Example:

- Mike decided not to apply for any credit cards immediately after bankruptcy. He waited a year, rebuilt his credit, and then applied for a car loan with a reasonable interest rate that he could afford.

5. Continue to Educate Yourself About Finances

Financial education is key to ensuring you don’t face the same challenges again in the future. Take time to learn about budgeting, saving, investing, and managing credit. Understanding how to handle money better will set you up for success in the future.

- How to Continue Learning:

- Take online courses about personal finance.

- Read books, articles, and blogs about budgeting, credit, and saving.

- Consider meeting with a financial planner or counselor to get personalized advice.

- Example:

- After his bankruptcy, Kevin took an online budgeting class. This helped him set up a budget and keep track of his spending, which prevented him from falling back into debt.

Final Thoughts

Filing for bankruptcy can be overwhelming, but it’s a fresh start that opens up new opportunities for financial recovery. While non-dischargeable debts may still exist, you now have a clearer path to managing them. By following the steps to rebuild your credit, stay on top of payments, and build an emergency fund, you can regain financial control and avoid falling back into debt.

Remember, bankruptcy is not the end — it’s the beginning of a new chapter in your financial life. With the right plan and mindset, you can move forward and build a stronger financial future.