When you save money for retirement, there are a few types of accounts that help you do this. One of the most common types is called an IRA (Individual Retirement Account). But did you know there’s another type of IRA called a Roth IRA? And you might be wondering, “Should I convert my IRA to a Roth IRA?”

In simple terms, converting means moving your money from a Traditional IRA to a Roth IRA. But before you do this, it’s important to understand how it works and if it’s the right choice for you. The reason many people consider converting is because a Roth IRA gives you some pretty cool benefits, like tax-free growth on your money!

This guide will help you understand what an IRA to Roth conversion is, why you might want to do it, and how it could affect your taxes. We’ll explain everything step by step, so you can make the best choice for your future!

What is an IRA to Roth IRA Conversion?

What is an IRA?

An IRA stands for Individual Retirement Account. It’s a type of savings account that helps you put money aside for retirement. There are two main types of IRAs: the Traditional IRA and the Roth IRA.

- In a Traditional IRA, the money you put in is tax-deferred, which means you don’t pay taxes on it right away. However, when you take the money out in retirement, you will have to pay taxes on it.

- A Roth IRA, on the other hand, is a little different. The money you put into a Roth IRA is taxed before you put it in. But the great thing is, when you take money out in retirement, you don’t pay taxes on it!

What Does It Mean to Convert Your IRA to a Roth IRA?

A conversion means you’re moving your money from a Traditional IRA to a Roth IRA.

Here’s how it works:

- You have money in a Traditional IRA.

- You decide to convert that money to a Roth IRA.

- The money you move to the Roth IRA will grow tax-free from then on.

- However, you will need to pay taxes on the amount you convert because your Traditional IRA money hasn’t been taxed yet.

So, when you do a conversion, you’re trading the tax-deferred growth of a Traditional IRA for the tax-free growth of a Roth IRA. This can be a great deal, but it’s important to understand that you’ll need to pay taxes now for that future benefit.

Why Consider Converting Your IRA to a Roth IRA?

What Are the Benefits of a Roth IRA?

A Roth IRA can offer some really cool benefits that make it worth considering, especially when you think about your future retirement savings. Here are the key benefits of a Roth IRA:

- Tax-Free Growth:

- In a Roth IRA, the money you put in grows without paying taxes. That means, as your investments grow over time, you won’t have to pay any taxes on the money when you take it out later. Imagine your money growing without anyone taking a piece of it!

- No Required Minimum Distributions (RMDs):

- With a Traditional IRA, the government makes you start taking money out at a certain age (usually 73), and you have to pay taxes on it.

- With a Roth IRA, you don’t have to take out any money if you don’t need it. You can leave your money to grow for as long as you want!

- Tax-Free Withdrawals in Retirement:

- When you retire and start using your Roth IRA, you don’t have to pay taxes on the money you take out. This is different from a Traditional IRA, where you pay taxes when you take the money out. With a Roth IRA, you can enjoy tax-free income when you retire.

Why Would Someone Want to Convert?

Now that we know the benefits of a Roth IRA, you might wonder why someone would choose to convert their Traditional IRA to a Roth IRA. Here are a few reasons:

- You Want Tax-Free Growth:

- Converting your IRA means you’ll be able to let your money grow without having to pay taxes on it later. If you expect your investments to grow a lot over time, this could be a big benefit.

- You Expect to Be in a Higher Tax Bracket in the Future:

- If you think your taxes will be higher when you retire (maybe because you’ll have more income or tax rates will go up), converting now can help you pay taxes at today’s lower rates instead of later when they might be higher.

- You Want to Avoid RMDs:

- If you don’t want to be forced to take money out of your account at a certain age, converting to a Roth IRA can help you avoid Required Minimum Distributions.

How Does the IRA to Roth Conversion Work?

Step-by-Step Process of Converting Your IRA to a Roth IRA

Converting your Traditional IRA to a Roth IRA isn’t too complicated, but it’s important to understand the steps involved. Here’s how it works:

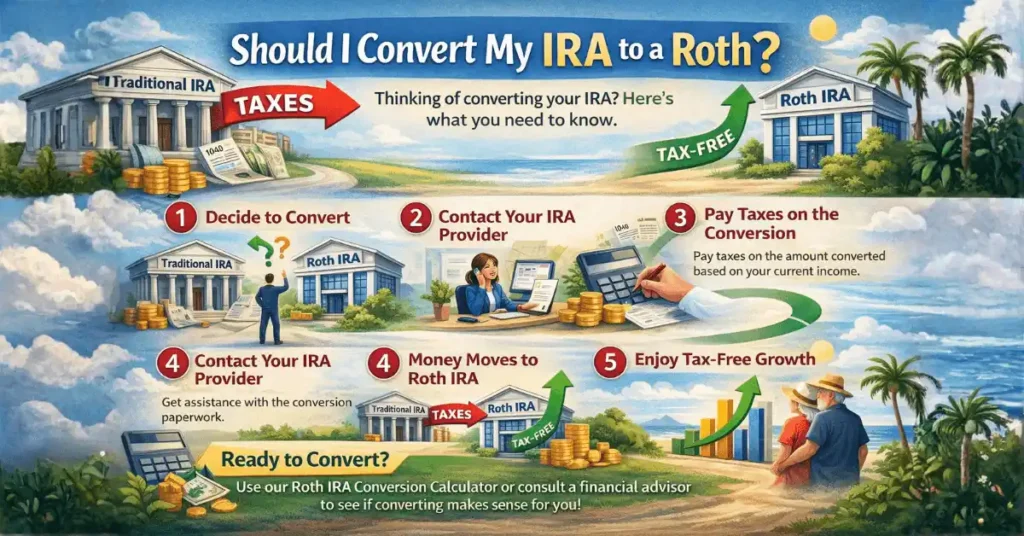

- Decide to Convert:

- The first step is deciding that you want to move money from your Traditional IRA to a Roth IRA. This is usually a decision you’ll make after considering the tax implications and the benefits of Roth IRAs.

- Contact Your IRA Provider:

- You’ll need to contact the company where you have your Traditional IRA. They will help you with the paperwork and process to convert your IRA to a Roth IRA.

- Pay Taxes on the Conversion:

- Here’s the important part: when you convert, you will have to pay taxes on the money you move from your Traditional IRA to the Roth IRA. This is because the money in your Traditional IRA hasn’t been taxed yet.

- For example, if you convert $10,000 from your Traditional IRA, you will need to pay taxes on that $10,000 now. The amount you pay depends on your current tax rate.

- Money Moves to the Roth IRA:

- After the taxes are paid, the money is transferred from your Traditional IRA to your Roth IRA. From now on, your Roth IRA will grow tax-free, and you won’t have to pay taxes when you take it out in retirement.

- Enjoy Tax-Free Growth:

- After the conversion is complete, your Roth IRA will grow without taxes, and you can enjoy tax-free withdrawals when you retire!

What Happens During the Conversion?

When you convert your IRA, your money changes the way it’s taxed. Here’s how:

- Before the Conversion:

- In a Traditional IRA, the money you contribute is tax-deferred. This means you don’t pay taxes on the money you put in now. But when you take it out in retirement, you’ll pay taxes on that amount.

- After the Conversion:

- In a Roth IRA, the money you put in is taxed before you put it in. But once the money is in, it grows without taxes. When you withdraw it in retirement, you don’t have to pay any taxes on it.

Tax Implications of Converting an IRA to a Roth IRA

How Does Converting an IRA Affect Your Taxes?

When you convert a Traditional IRA to a Roth IRA, you’ll need to pay taxes on the money you move from your Traditional IRA to the Roth IRA. This is because the money in a Traditional IRA hasn’t been taxed yet, but a Roth IRA requires you to pay taxes before the money is put in.

Here’s a simple breakdown:

- You’ll Pay Taxes on the Converted Amount:

- When you convert, the IRS treats the money you move to your Roth IRA as income for the year. For example, if you convert $10,000, you will need to pay taxes on that $10,000 now (not when you withdraw it later).

- Your Tax Rate Depends on Your Income:

- How much you pay in taxes depends on how much income you have that year. If your income is higher, you might fall into a higher tax bracket (which means you’ll pay a higher percentage of taxes).

- For example, if your annual income is $50,000 and you convert $10,000, you’ll pay taxes on $60,000 in total income for that year, which could push you into a higher tax bracket.

- Potentially Higher Taxes:

- If you convert a large amount from your Traditional IRA, it can increase your taxable income significantly, which might mean you pay higher taxes for that year. This is something to keep in mind when deciding how much to convert at once.

How to Estimate the Tax Impact

To help estimate how much tax you’ll owe on the conversion, you can use a Roth IRA Conversion Calculator. This tool helps you figure out how much tax you’ll need to pay based on your current tax rate and how much you plan to convert. It will give you a better idea of how the conversion might affect your overall tax situation.

Example:

- Let’s say you have $20,000 in your Traditional IRA, and you decide to convert the entire amount to a Roth IRA. If you’re in the 22% tax bracket, you’ll pay 22% of $20,000, which is $4,400 in taxes.

- After paying the taxes, the remaining $15,600 will be moved to your Roth IRA.

What Happens if You Convert Too Much?

It’s important not to convert too much all at once, because it could push you into a higher tax bracket, meaning you’ll pay more taxes. Here’s an example:

- If you usually earn $50,000 a year and you convert an additional $50,000, your total income for the year will be $100,000. This could push you into a higher tax bracket, and you’ll pay more taxes than if you had converted smaller amounts over several years.

Tip: Many people choose to convert in smaller chunks over multiple years to avoid a huge tax bill all at once.

Who Should Consider a Roth IRA Conversion?

Who Benefits the Most from Converting?

Converting from a Traditional IRA to a Roth IRA can be a good idea for many people, but it’s especially beneficial for certain groups. Let’s look at who could benefit the most from a Roth IRA conversion:

- People in Lower Tax Brackets:

- If you’re in a lower tax bracket now, it could make sense to convert your IRA to a Roth IRA. You would pay taxes on the converted amount at a lower rate, saving you money in the long run.

- For example, if you’re just starting your career or you’re retired and living on a smaller income, you might be in a lower tax bracket. Converting now means you pay less tax on the amount you move to a Roth IRA.

- Younger People or Those Early in Their Career:

- If you’re young and have many years ahead of you before retirement, converting to a Roth IRA now can allow your money to grow without taxes for a long time. The earlier you convert, the more time your money has to grow tax-free.

- If you’re just starting to save for retirement and are in a low tax bracket, it might be a good time to convert, especially if you expect your income and tax bracket to grow as you get older.

- People Who Expect Higher Taxes in the Future:

- If you think tax rates will rise in the future, converting to a Roth IRA now can be a smart choice. By converting when taxes are lower, you can avoid paying higher taxes on your retirement savings down the road.

- Retirees or Near-Retirees:

- If you’re close to retirement and you expect your tax rate to stay the same or decrease, a conversion can still be a good move. By converting now, you can make sure that you don’t pay taxes on your withdrawals in retirement.

- A Roth IRA can be especially useful for retirees who don’t want to be forced to take money out due to Required Minimum Distributions (RMDs). Roth IRAs don’t have RMDs, so you can leave your money in the account as long as you like.

- High Earners Using the Backdoor Roth Strategy:

- If your income is too high to contribute directly to a Roth IRA (there are income limits for Roth IRA contributions), you might use a backdoor Roth IRA strategy. This involves converting a Traditional IRA to a Roth IRA even if your income exceeds the limit for direct contributions.

Special Considerations:

- If You’re in a High Tax Bracket:

- If you’re in a high tax bracket now, converting a large sum at once could mean paying a lot in taxes. It may still be worth considering, but you should think about converting smaller amounts over time to avoid a huge tax bill all at once.

- If You Don’t Need the Money Right Away:

- A Roth IRA works best when you don’t need to take money out right away. It’s designed for long-term growth. If you’re planning to use the money soon, a Traditional IRA might make more sense, as you can withdraw the money earlier without worrying about the 5-year rule for Roth IRAs.

The Best Time to Convert Your IRA to a Roth IRA

When Is the Right Time to Convert?

Timing your IRA to Roth IRA conversion is important because it can affect how much you pay in taxes. The best time to convert depends on a few factors, including your income, tax rate, and financial goals. Here are some times when converting might make the most sense:

1. When You Are in a Low Tax Bracket

If your income is low in a particular year—maybe because you’re just starting your career, between jobs, or retired—this can be a great time to convert to a Roth IRA. Here’s why:

- Low tax rates mean you’ll pay less in taxes on the amount you convert.

- For example, if your annual income is low, you might be in a lower tax bracket. This means if you convert $10,000 from your Traditional IRA to your Roth IRA, you’ll pay taxes on that $10,000 at a lower rate compared to a year when your income is higher.

2. When You Experience a Temporary Drop in Income

Some people experience a temporary drop in income—for example, if they take a break from work or retire early. This can be a perfect opportunity to convert because your tax rate will likely be lower.

- If your income is lower than usual, it means you won’t have to pay as much in taxes for the conversion. You could take advantage of a lower tax bracket in this scenario.

3. When You Plan to Leave Your Money in the Roth IRA for a Long Time

Roth IRAs are great for people who are looking for long-term growth. If you plan to leave the money in your Roth IRA for many years, you can take advantage of tax-free growth. The earlier you convert, the more time your investments have to grow without paying taxes.

- The longer your money stays in a Roth IRA, the bigger the potential benefit of not paying taxes on the growth. So, younger people or those still many years away from retirement might consider converting early.

4. In Years with Lower Income or Special Circumstances

If you have a year with lower-than-normal income, such as after selling a business or receiving a large bonus, it might be a good time to convert some of your Traditional IRA funds to a Roth IRA.

- By converting during a year when your income is lower, you’ll likely be in a lower tax bracket, and thus pay less tax on the conversion. For example, if you had a year with unusually low income (say, you were on a sabbatical or didn’t work), converting could be a smart move.

5. Gradual Conversions Over Time (Phased Conversions)

Instead of converting a large sum all at once, some people choose to spread out their conversions over multiple years. This can help minimize the tax burden because:

- Converting smaller amounts each year keeps you in a lower tax bracket.

- It also allows you to manage the taxes you owe, since converting a large sum all at once could push you into a higher tax bracket and result in a much larger tax bill.

Consider Future Tax Rates

If you expect tax rates to go up in the future, converting sooner rather than later may be a smart move. Taxes might be lower now compared to when you retire, and by converting to a Roth IRA today, you lock in the lower tax rate and avoid paying higher taxes later.

Common Mistakes to Avoid During the Conversion

Converting Too Much at Once

One of the most common mistakes people make when converting their Traditional IRA to a Roth IRA is converting too much money all at once. While converting a large sum can seem like a good idea to get it over with, it can have significant tax consequences.

- When you convert a large amount in one year, it increases your taxable income, which could push you into a higher tax bracket.

- This means you might end up paying more taxes than if you had spread out the conversion over several years.

Tip: A safer approach is to convert smaller amounts each year. This way, you can stay within your current tax bracket and avoid a huge tax bill.

Not Planning for the Tax Bill

Another mistake is not planning for the tax bill. Since the money you convert from your Traditional IRA to your Roth IRA is treated as income, you will have to pay taxes on it. If you don’t plan ahead, you could be caught off guard by the amount of tax you owe.

- You’ll need to make sure you have enough funds outside of your IRA to cover the taxes, instead of taking the tax money from your IRA itself.

- If you take the tax money out of your Roth IRA or Traditional IRA, it will reduce the amount that can grow tax-free in the Roth IRA.

Tip: Always have a separate tax savings fund to cover the conversion tax. This ensures you don’t reduce your retirement savings.

Not Understanding the Five-Year Rule

The Five-Year Rule can be confusing for some people, but it’s an important aspect of Roth IRAs. Here’s what it means:

- Once you convert your IRA to a Roth IRA, you must wait five years before you can take out any converted funds tax-free.

- If you take out money before the five years are up, you might have to pay penalties and taxes on the earnings.

This rule doesn’t apply to your contributions (the money you put in) to a Roth IRA, but it does apply to the money you convert from your Traditional IRA.

Tip: If you’re planning on using the converted funds soon after retirement, you might want to consider waiting until the five years have passed to avoid penalties.

Overlooking the Impact of Future Taxes

While a Roth IRA offers tax-free growth, converting means you will have to pay taxes now on the amount you move from your Traditional IRA. Some people overlook the possibility that tax rates may increase in the future, which makes the conversion even more beneficial today.

- If tax rates go up in the future, converting now could save you money in the long run, even though you’ll pay taxes on the conversion today.

Tip: Consider the potential for future tax increases when deciding whether to convert. If you think taxes will rise, it might be a good idea to convert more money now while the tax rate is lower.

Forgetting About Other Retirement Savings

It’s also important to remember that your Roth IRA is just one piece of your overall retirement plan. Converting your IRA to a Roth IRA might be a good move, but you should also keep an eye on your other retirement savings, like your 401(k) or other investment accounts.

- Converting too much could reduce your traditional retirement savings, and you might need to rely on your Roth IRA for everything.

- It’s a good idea to have a balanced approach, where you have a mix of tax-deferred and tax-free accounts in retirement.

Tip: Be sure to consider all your retirement accounts and think about how the conversion fits into your overall retirement strategy.

Roth IRA Conversion Strategies

Phased Conversion Strategy

One of the best strategies for converting a Traditional IRA to a Roth IRA is to convert in phases over multiple years. This means you don’t move all of your IRA money to a Roth IRA in one go. Instead, you convert smaller amounts each year.

Why should you do this?

- Stay in a Lower Tax Bracket:

- When you convert too much money at once, it could push you into a higher tax bracket. By converting smaller amounts, you can spread out the tax burden over time and keep your taxes lower each year.

- For example, if you’re in the 22% tax bracket and you convert $50,000, your taxes will be based on that larger amount. But if you convert $10,000 each year for five years, you’re less likely to jump into a higher tax bracket.

- Manage Taxes More Effectively:

- Converting in phases gives you more control over how much tax you’ll pay. You can decide how much to convert based on your income for that year and your current tax bracket, avoiding any surprises.

Tip: Consider converting enough to maximize your current tax bracket but not so much that it pushes you into the next higher bracket. You can use a tax calculator to estimate the best amount to convert each year.

Backdoor Roth IRA Strategy for High Earners

If your income is too high to contribute directly to a Roth IRA (there are income limits for direct contributions), you might use the Backdoor Roth IRA strategy. This strategy allows high-income earners to still convert their money to a Roth IRA by using a two-step process:

- Contribute to a Traditional IRA:

- First, you contribute money to a Traditional IRA (which doesn’t have income limits). You can do this regardless of how much money you make.

- Convert to a Roth IRA:

- Once the money is in your Traditional IRA, you convert it to a Roth IRA. There are no income limits for this conversion, so you can move the money into a Roth IRA and benefit from tax-free growth.

Why It’s Helpful: This strategy works for people who are high-income earners and exceed the income limits for direct Roth IRA contributions. It’s a clever way to still enjoy the benefits of a Roth IRA.

Tip: When using the backdoor strategy, be aware of any taxes on the conversion. If you have other Traditional IRA money that hasn’t been taxed yet, you may owe taxes when you convert.

Convert During Low-Income Years

If you know you’ll have a low-income year, whether it’s due to early retirement, a sabbatical, or a break in employment, it could be a perfect opportunity to convert your IRA.

Why?

- Lower Tax Rates: With less income, you may fall into a lower tax bracket for that year. This means you can convert more money from your Traditional IRA to your Roth IRA and pay fewer taxes on it.

- This strategy works especially well for people who are planning to retire early or take a break from work, because they can convert a significant portion of their IRA when they’re in a low tax bracket.

Tip: Take advantage of these low-income years to convert a larger amount. Just make sure to plan carefully and keep an eye on your overall tax situation.

Tax Diversification Strategy

A great long-term strategy is to have both tax-deferred accounts (like a Traditional IRA) and tax-free accounts (like a Roth IRA) in your retirement portfolio. This is called tax diversification. Having both types of accounts gives you flexibility in retirement.

Why is this important?

- Flexibility in Retirement:

- With both types of accounts, you can decide when to pay taxes in retirement. For example, if your tax rate is high in a particular year, you can pull money from your tax-free Roth IRA to avoid paying more taxes.

- Tax Control:

- In retirement, you might have the option to pull from your Traditional IRA when your tax rate is lower and use your Roth IRA for tax-free withdrawals when tax rates are higher. This gives you more control over your tax situation.

Tip: If possible, try to convert a portion of your Traditional IRA to a Roth IRA each year to achieve this balance. Over time, having both accounts will help you plan more effectively for taxes in retirement.

Should You Convert Your IRA to a Roth IRA?

Converting your Traditional IRA to a Roth IRA can be a great financial move, but it’s not the right choice for everyone. The decision depends on several factors, including your current tax situation, future income, and retirement goals.

Here are the key takeaways:

- Benefits of a Roth IRA:

- Tax-Free Growth: Your money grows without taxes, so you can keep more of your retirement savings in the long run.

- No Required Minimum Distributions (RMDs): Unlike a Traditional IRA, you won’t be forced to take money out once you reach a certain age.

- Tax-Free Withdrawals: When you retire, you can take money out of your Roth IRA without paying any taxes, unlike the Traditional IRA, where withdrawals are taxed.

- When to Convert:

- Consider converting if you’re in a low tax bracket, expect higher taxes in the future, or want to avoid RMDs in retirement.

- If you’re unsure, gradual conversions over several years can help you manage the taxes and stay in a lower tax bracket.

- Common Mistakes to Avoid:

- Don’t convert too much at once, as it can push you into a higher tax bracket.

- Make sure you have enough money set aside to pay the taxes on the conversion.

- Be mindful of the Five-Year Rule for conversions and make sure you understand how long you need to wait before withdrawing converted funds.

Next Steps:

- Use a Roth IRA Conversion Calculator: If you’re unsure how much tax you’ll owe or how converting will impact your finances, try using a Roth IRA conversion calculator. It can give you a better idea of the costs and help you make a more informed decision.

- Consult a Financial Advisor: Converting your IRA to a Roth IRA is a big decision that can have long-lasting effects on your retirement savings. Speaking with a financial advisor can help you understand how this move fits into your overall retirement strategy.

- Take Action: Once you’ve done your research and consulted with an advisor, you can start the conversion process with your IRA provider. Remember to take your time and consider all factors before making a decision.

If you’re ready to see how a Roth IRA conversion could impact your savings, use our Roth IRA Conversion Calculator today! Or, if you need personalized advice, reach out to a financial advisor to help you plan your conversion strategy.